Laatst bijgewerkt op 4 October 2023 door Robin

Depending on who you ask, you will get a different answer to the question, "What is the freelancer trap?". After all, there are many different views on the term, all of which affect your success as a starting freelancer to some extent.

We've listed them for you below and provide some additional information. We conclude with a few real-life tips that will help you avoid the various freelancer traps.

Freelancer trap 1: cashflow vs. revenue

Cash flows, until it stops. Especially in the first few months after your establishment, it is important to remember that turnover is not the same as cashflow. You have just paid your establishment costs, invested in the necessary office equipment and signed the leasing contract for your new company car.

Since you already landed your first assignment, you plan to fund those costs with your first turnover. However, the chances of your client paying immediately when he receives the invoice are slim.

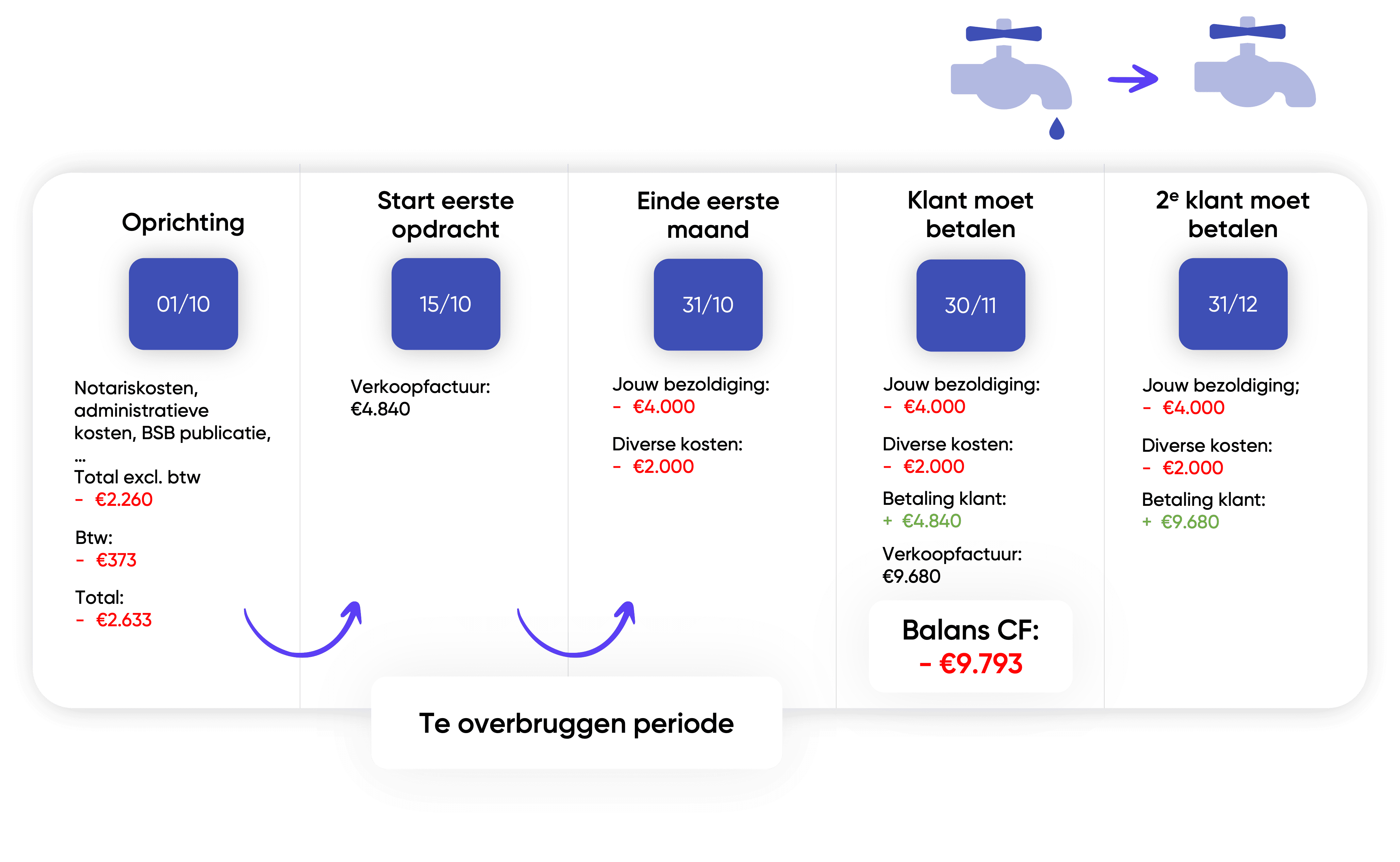

Soon you find yourself in the situation below. Between your establishment date and the first customer payment is a bridgeable period of around 1.5 to 2 months. Although your turnover on 15/10 already amounts to €4,840, your cashflow remains negative. At the end of the 2nd month after your establishment, your cashflow position is overdrawn by almost €10,000.

Conclusion: make sure you set aside a sufficient amount of starting capital to get through the first few months after your establishment. It may be allowed to set up a limited company from €1 starting capital these days, but reality shows that in most cases such an amount is grossly insufficient.

Freelancer trap 2: “The Frankenstein business”

The second form of freelancer trap has to do with building your business as a freelancer. After your start-up, you probably invest most of your time in finding clients/assignments. After all, you know exactly what you have to offer, and you'll take care of the administrative formalities once the client is converted.

As long as your client base is relatively small, this approach can work. However, as your schedule fills up, you find that you are increasingly losing more time to manual, time-consuming processes. Sending out quotes, putting customer data into a spreadsheet, tracking payments... it's all part of the job!

Worst of all: you can't invoice those hours to your clients. And since your schedule is so full right now, it's hard to find time to address the underlying lack of structure.

You've built a "Frankenstein business": you manage each client separately, without paying attention to the bigger picture. Over time, you find yourself managing an overfilled agenda, having difficulties making deadlines for your clients, and surely don't have any more time to work on the framing of your processes.

There is no easy solution to this problem; a stitch in time saves nine! From your establishment, pay enough attention to framing your processes, from onboarding a new client to closing an assignment. Think about preparing templates for administrative documents, working out procedures for certain situations and a strong time-management system.

Our approach

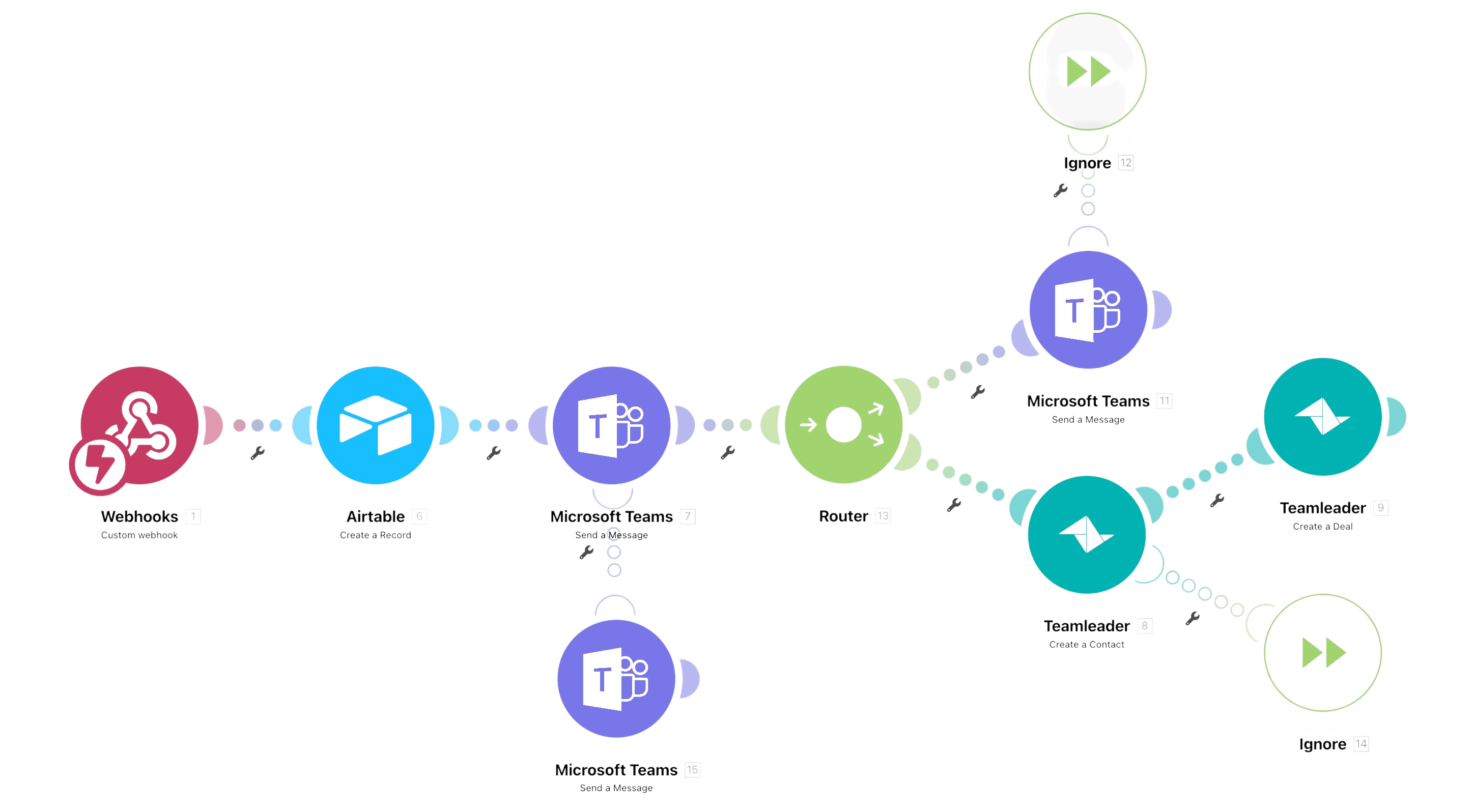

Practice what you preach! Since Digicount itself is a growing SME, we too have to make sure we don't build a Frankenstein business. Below you can see, as an example, our flow to quickly offer potential customers a tailor-made quote.

The flow runs automatically when a webhook is triggered. This happens when a potential customer submits the form for a tailor made offer on our website. In it, we ask a lot of financial and non-financial questions to filter all leads properly. We have a clear picture about our ideal client, and make his or her offer based on the input in the survey.

The customer data is then stored in Airtable, a kind of Excel in the cloud. We also get a notification in a specific Teams channel so that everyone can follow up the lead efficiently. A contact, and a deal, are also immediately created in our CRM package - Teamleader. This saves us a few minutes of manual work with each lead.

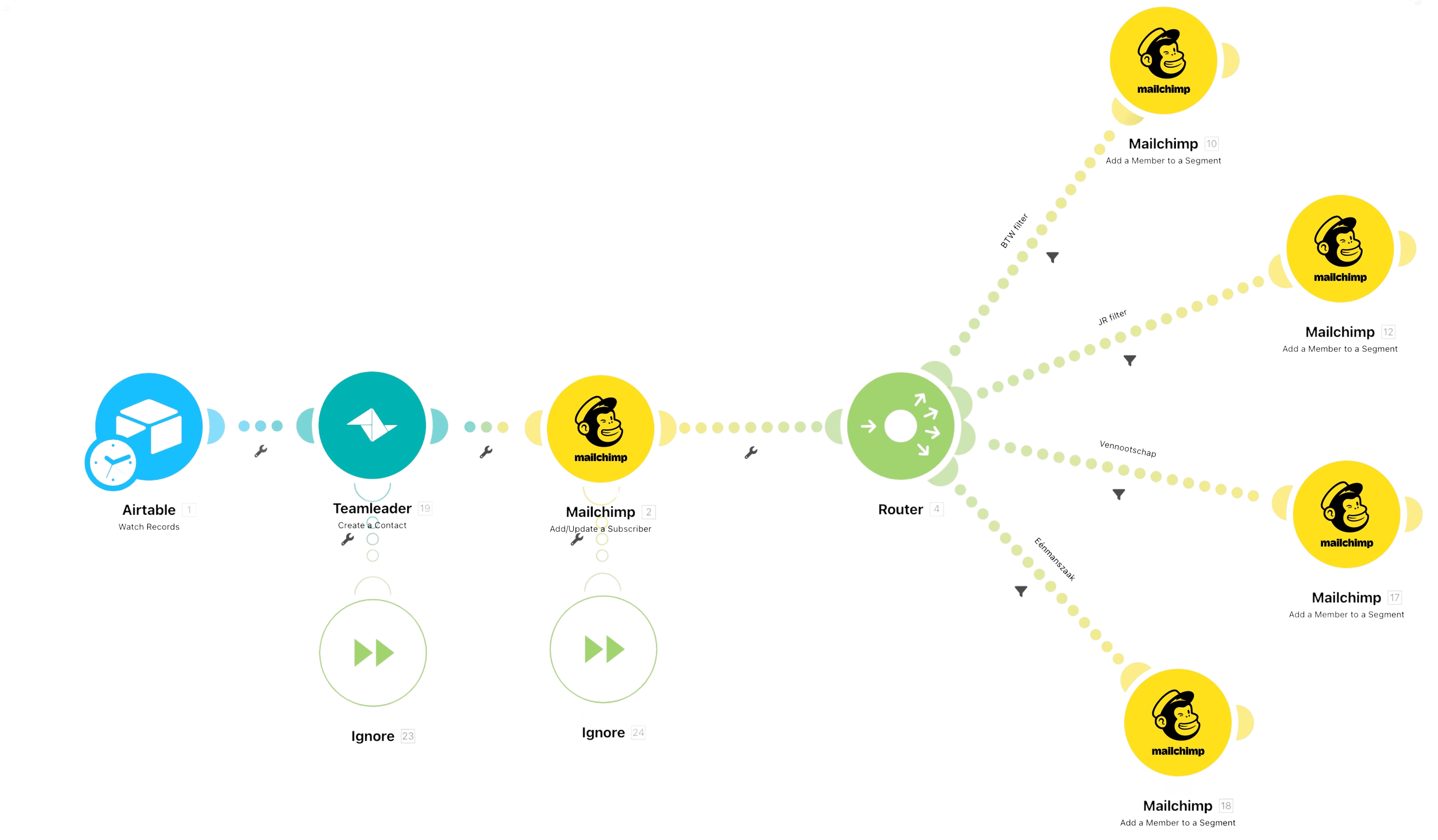

We also regularly send out newsletters to our existing customers. This is how we inform them of certain deadlines, new accounting legislation and other relevant topics. As a second example, you can see below how we segment our customer base in Mailchimp to send out targeted campaigns.

The flow regularly checks whether new customer data has been added in Airtable. If so, a contact is created in Teamleader and Mailchimp. Based on the data in Airtable, contacts are also assigned tags in Mailchimp, e.g. 'sole proprietorship', or 'VAT liable'.

Afterwards, when setting up a campaign, it's child's play to set it up to send only to VAT-registered limited companies , for example.

Freelancer trap 3: it starts with a dream…

Many freelancers start their careers with the bright prospect of now being their own boss: lots of freedom, flexible working hours and no nagging from above.

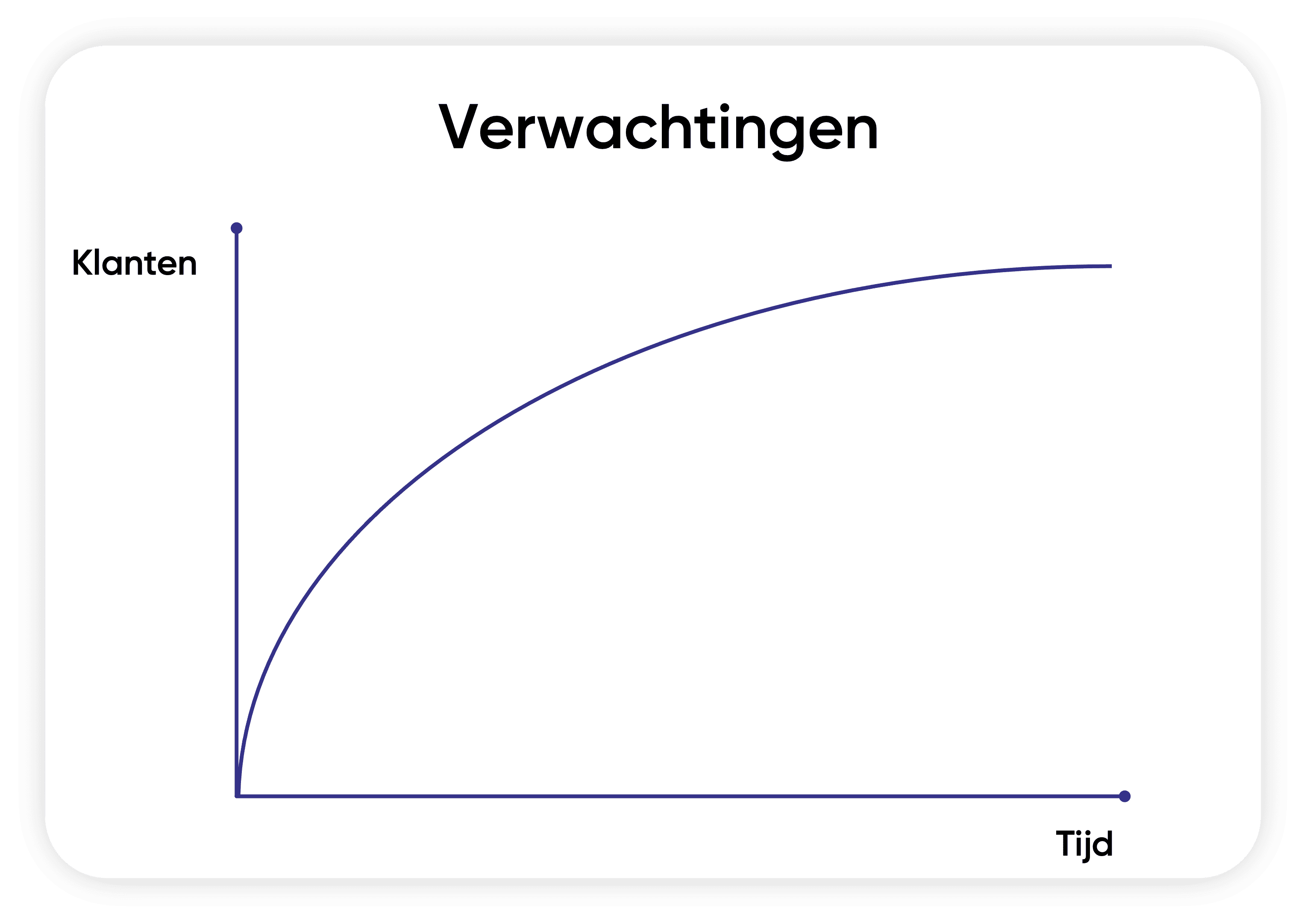

Your expectations look like this: as time goes on, your schedule quietly fills up with clients. Everything is manageable and your work-life balance is good. You also have the necessary time to keep your administration in order.

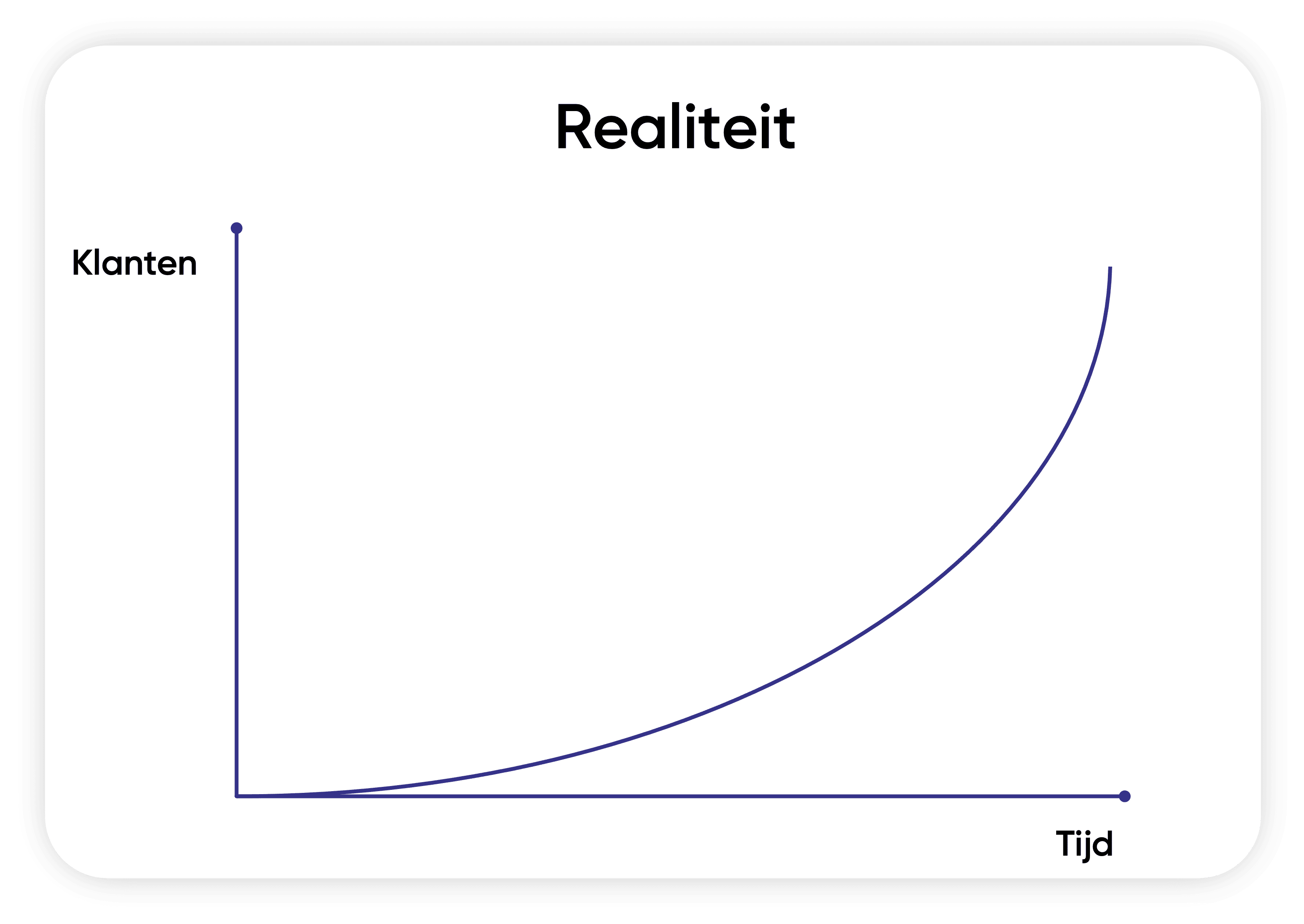

The reality is often different. It takes a fairly long time to land your first client, but after that, your business gains momentum. In addition to deadlines for your existing clients, new clients keep coming in. Eventually, there is no time left to manage that growth and you're stuck in a busy routine.

A tip: dare to say no! Imagine the following situation: you have 10 customers, generating a monthly turnover of €10,000. You would like to continue growing, but your calendar is jam-packed with deadlines for your existing customers.

You decide to increase your prices by 25%. No doubt there will be customers who don't agree, and want to renegotiate. Even if during those negotiations a significant part of your customer base leaves, you probably still achieve the same turnover (or more). Moreover, you now have much more space in your schedule to attract new clients.